An Unbiased View of Thomas Insurance Advisors

Wiki Article

What Does Thomas Insurance Advisors Do?

Table of ContentsThe Buzz on Thomas Insurance AdvisorsThomas Insurance Advisors Can Be Fun For AnyoneWhat Does Thomas Insurance Advisors Do?Some Known Details About Thomas Insurance Advisors Top Guidelines Of Thomas Insurance Advisors

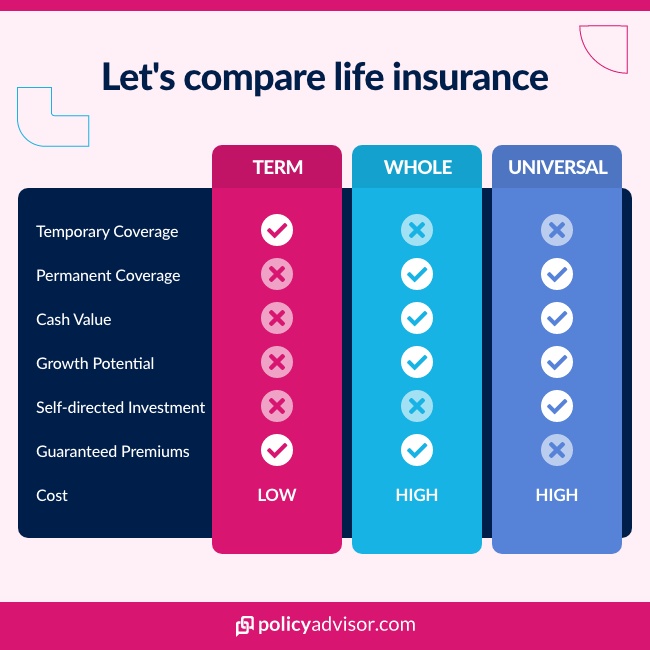

The cash value part makes entire life extra complicated than term life due to fees, taxes, passion, and other stipulations. Universal life insurance policy is a flexible irreversible life insurance policy plan that lets you decrease or enhance just how much you pay towards your regular monthly or yearly costs in time. If you reduce just how much you spend on premiums, the difference is withdrawn from your plan's cash money worth.A global policy can be much more pricey and also complicated than a standard entire life policy, specifically as you age and also your premiums raise (https://www.tripadvisor.in/Profile/jstinsurance1). Best for: High earners that are attempting to develop a nest egg without getting in a higher revenue bracket. Exactly how it works: Universal life insurance coverage permits you to adjust your costs and survivor benefit depending upon your needs.

The Facts About Thomas Insurance Advisors Uncovered

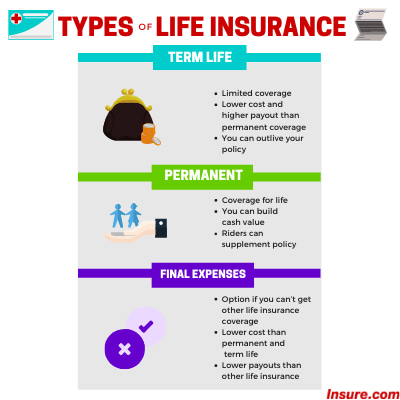

Pro: Gains potential variable plans may earn even more passion than standard entire life. Disadvantage: Financial investment threat potential for shedding cash if the funds you selected underperform. Final expense insurance policy, also referred to as funeral insurance coverage, is a kind of life insurance policy developed to pay a small survivor benefit to your family members to assist cover end-of-life expenses.

Due to its high prices as well as lower insurance coverage amounts, final expense insurance policy is typically not as excellent a worth as term life insurance policy. Best for: People that have difficulty getting typical protection, like elders and people with severe health problems. Just how it functions: Unlike the majority of standard plans that need a clinical examination, you just require to respond to a couple of questions to get approved for final expense insurance policy.

Thomas Insurance Advisors Can Be Fun For Anyone

Pro: Ensured protection easy access to a little benefit to cover end-of-life expenses, including medical expenses, burial or cremation services, and coffins or containers. Disadvantage: Cost expensive costs for reduced protection amounts. The finest method to select the plan that's finest for you is to speak with a monetary consultant and collaborate with an independent broker to find the right policy for your certain demands.Term life insurance policies are typically the finest solution for individuals that require economical life insurance for a specific period in their life (https://www.producthunt.com/@jstinsurance1). If your objective is to offer a security net for your family members if they had to live without your earnings or contributions to the family members, term life is likely a great suitable for you.

If you're already optimizing payments to traditional tax-advantaged accounts like a 401(k) as well as Roth individual retirement account and desire one more financial investment car, long-term life insurance might help you. Final cost insurance policy can be an alternative for people that could not have the ability to get insured or else as a result of age or major health and wellness problems, or elderly consumers who do not intend to burden their households with burial prices."The appropriate type of life insurance policy for every individual is totally based on their private situation," says Patrick Hanzel, a licensed monetary coordinator as well as progressed preparation manager at Policygenius.

Fascination About Thomas Insurance Advisors

A number of these life insurance policy options are subtypes of those featured over, suggested to serve a particular purpose, or they are specified by how their application procedure also referred to as underwriting works - https://wordpress.com/post/jstinsurance1.wordpress.com/9. By kind of protection, By sort of look these up underwriting Team life insurance, also called team term life insurance policy, is one life insurance agreement that covers a team of individuals.Team term life insurance policy is commonly supported by the insurance holder (e. g., your employer), so you pay little or none of the policy's premiums. You get protection as much as a limit, typically $50,000 or one to two times your annual wage. Group life insurance policy is inexpensive as well as simple to receive, but it seldom supplies the degree of protection you might need as well as you'll most likely lose insurance coverage if you leave your job.

Best for: Anybody that's used group life insurance policy by their employer. Pro: Convenience team policies provide ensured coverage at little or no price to workers.

Little Known Questions About Thomas Insurance Advisors.

With an MPI policy, the recipient is the mortgage business or lender, rather of your household, and the survivor benefit reduces with time as you make mortgage settlements, similar to a decreasing term life insurance policy plan. Most of the times, acquiring a common term plan rather is a better choice. Best for: Anyone with home loan responsibilities who's not eligible for standard life insurance policy.The policy is linked to a solitary debt, such as a mortgage or business loan.

You're assured authorization and, as you pay down your lending, the survivor benefit of your policy lowers. Annuities in Toccoa, GA. If you die while the policy is in pressure, your insurance coverage supplier pays the survivor benefit to your lending institution. Home loan defense insurance (MPI) is among the most usual kinds of credit score life insurance coverage.

Report this wiki page